SAP Vertex answers the trillion-dollar question: How do you stay compliant when 300 + tax rules change each day?

Setting the Scene

Governments are no longer auditors—they’re co-processors. Continuous transaction controls embed tax authorities inside your workflows.Sovos

Defining the Platform

SAP Vertex combines Vertex O-Series Cloud with SAP connectors, geospatial sourcing, DRC, and AI-powered rate engines. It delivers:

- Unlimited calc calls, quotes, and validations.

- Sub-second latency—crucial for B2C checkout.

- 24 × 7 uptime across multi-cloud zones.

2025’s Five Most Disruptive Compliance Shifts

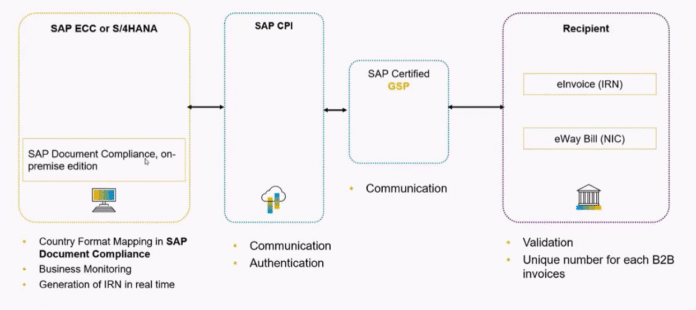

- E-invoice mandates in Germany, Poland, and Spain.

- Live ledger access pilots in Australia.

- OECD Pillar Two top-up taxes hitting MNEs.Viewpoint

- Real-time SAF-T pushes in the Nordics.

- S/4HANA clean-core pressure—extensions must be side-by-side, not in-core.Vertex, Inc.

How SAP Vertex Tackles Each Shift

| Shift | SAP Vertex Capability | Result |

|---|---|---|

| E-invoice mandates | Pre-built country packs | Zero-code rollouts |

| Live ledger | API webhooks | Instant authority pingbacks |

| Pillar Two | Multi-jurisdiction calc rules | Accurate effective tax rate |

| SAF-T | XML export templates | Faster audits |

| Clean-core | Side-car micro-services | No custom ABAP debt |

Learning Journey

Ready to master SAP Vertex?

- Enroll in a tailored course: SAP FI Vertex Training.

- Preview key labs on YouTube: Vertex tutorial.

- Join the SAP Community DRC group for live Q&As.pages.community.sap.com

Viral Angle—Success Stories

- A mid-market retailer cut audit penalties by 93 % in six months.

- A SaaS unicorn launched in 14 states overnight—thanks to auto-jurisdiction rules.

Action Plan for 2025

- Map gap vs. CTC road-maps.

- Budget S/4 migration tax-workstream.

- Embed SAP Vertex with clean-core extensibility.

Final Word

SAP Vertex is the game-changer for indirect tax in 2025—because staying still isn’t neutral; it’s moving backward. Jump ahead now.